How scaled SaaS companies grow

Cloud companies persistently grow through increasing and capturing TAM. Here are some signals to watch out for

TL;DR

Persistent revenue growth is the key driver of equity value appreciation for cloud companies. Companies generate persistent revenue growth through consistently (1) growing TAM and (2) capturing TAM. These are some signals for each.

Why persistent revenue growth matters

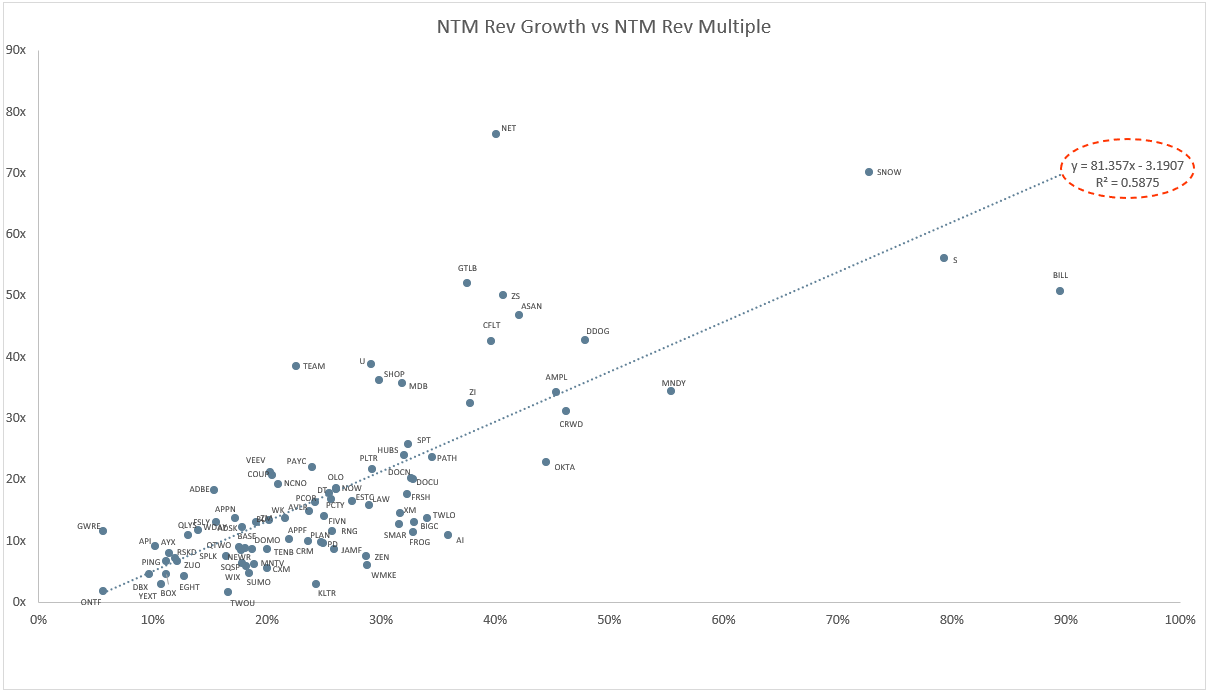

But first, why this matters… the market values cloud companies as a multiple of revenue (see chart below h/t Jamin Ball).

Revenue x rev multiple drives equity value

If you’re growing faster, your multiple is higher. When your growth slows down, your multiple also comes down. This is called multiple compression and can lead to equity value stagnation.

The way to escape equity value stagnation is persistent revenue growth… continuing to grow at a similar rate year after year. If you can do this you can retain a high multiple that you apply to a growing revenue number, and voila… equity value!

But driving persistent revenue growth is hard.

The math is working against you. If in Y1 you grow at 100% from $1 → 2, your ability to grow at 100% in Y2 from $2 → 4 is much harder. In this example it’s a doubling of results for the same growth number.

This means that you can’t just do the same thing year after year and expect to drive persistent growth. Your execution needs to grow as well.

Companies generate persistent revenue growth through consistently (1) growing total addressable market (“TAM”) and (2) capturing that TAM with velocity.

Here is how they do it, and some signals to look for:

Grow TAM

The TAM of your product is the size of the problem(s) that it addresses. Companies grow TAM in three ways (h/t Jared Sleeper):

Market tailwinds - Solve a core problem that is itself growing. E.g. AWS’s TAM is growing as fast as the transition of + creation of new cloud software

Product extensibility - The product is flexible enough such that you can extend its solution to solve new problems. E.g. Airtable’s product is so flexible that you can use it to solve many existing and future collaboration/workflow-based problems

Product is a center of gravity - The product’s underlying asset can be leveraged to solve new problems. E.g. Salesforce turning its data model into a platform to enable 3rd parties to build on top of

The more of these TAM growth vectors a company can pursue, the better. Not only do you have more lines in the water, but they reinforce each other.

Capture TAM

Growing TAM isn’t enough to maintain persistent revenue growth. You need to make sure that you’re also converting that new TAM into revenue, i.e. capturing TAM.

And because revenue persistence is measured on a year vs. year basis, you need to do this quickly by reducing the cycle time between TAM growth + TAM capture.

Here are some signals that I’ve seen result in companies capturing incremental TAM with velocity.

Product

Customer’s COGS - Your product gets classified as COGS by your customers. As a company’s revenue grows, they expect their cost of revenue to grow ~in line with revenue, and operating expense to grow slower than revenue. So if you’re selling a product that is classified as COGS, you will have an easier time capturing the value of your product’s TAM growth. This goes hand in hand with volume pricing below.

Product flexibility - This TAM growth method has a built-in TAM capture advantage. Your product will only be used for new purposes if it’s already proving value. In which case the risk associated with directing that product towards a new problem is low, which will lead to low friction distribution

Fast time to value - adding more product modules that leverage your core asset to solve new problems is great. And it’s even better if there aren’t very long deployment cycles resulting in slow time to value. Slow time to value acts as a governor on your customer’s ability to consume more products, and thus your ability to capture that TAM at speed

Business model

Volume pricing - Volume pricing is an auto capture mechanism for incremental TAM from existing products. If the value of your product is tied to its usage, this is a no brainer

Product-led growth - As you might expect, coordination gets very complicated when you’re growing & capturing your TAM across multiple vectors. One way of simplifying this coordination is to let each of your customers decide how they want to continue growing with you - a hyper-focused business model - which is enabled via software and PLG motions

What would you add to this list? Let me know.